Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Mar-04-2009 11:45

TweetFollow @OregonNews

TweetFollow @OregonNews

New Data Shows One-Fifth of all Mortgages Underwater

Salem-News.comSalem Shows 10.1 Percent of Mortgages in Negative Equity.

Images: First American CoreLogic |

(SALEM, Ore.) - More than 8.3 million U.S. mortgages, or 20 percent of all properties with a mortgage, were in a negative equity position as of December 31, 2008, according to newly released data from First American CoreLogic.

This compares with 7.6 million, or 18 percent, of all mortgages in negative equity as of September 30, 2008. Approximately 700,000 additional borrowers slid into a negative equity position in the last quarter.

Negative equity, often referred to as "underwater" or "upside down," means a borrower owes more on their mortgage than the home is worth. In addition, the data shows there are 2.2 million mortgages nationwide that are approaching negative equity.

These are defined as mortgages within 5 percent of being in a negative equity position. Together, negative equity and near negative equity mortgages account for 25 percent of all residential properties with a mortgage nationwide.

In Salem, 5,538, or 10.1 percent, of all properties with a mortgage are in negative equity. An additional 2,215 mortgages, or 4.0 percent, are in near negative equity, resulting in a total of 14.2 percent* of all outstanding mortgages in negative equity and near negative equity for Salem.

During the fourth quarter of 2008, a monthly average of nearly 230,000 borrowers became "upside down." California led the way with a monthly average of 43,000 newly negative equity borrowers, followed by Texas (16,000), Nevada (15,000), Florida (14,000) and Virginia (14,000).

Nationwide, the distribution of negative equity is heavily skewed to a small number of states. Nevada has by far the highest percentage of negative equity – more than half of mortgage borrowers in that state are now upside down.

The average loan to value (LTV) ratio for properties with a mortgage in Nevada was 97 percent, or less than $8,000 in equity leaving the typical mortgaged homeowner with virtually no cushion for the rapidly declining home values. Michigan was ranked second in the nation with a negative equity share of 40 percent, which is double the national negative equity share.

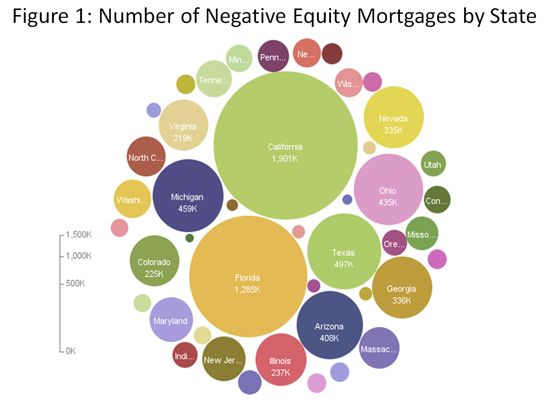

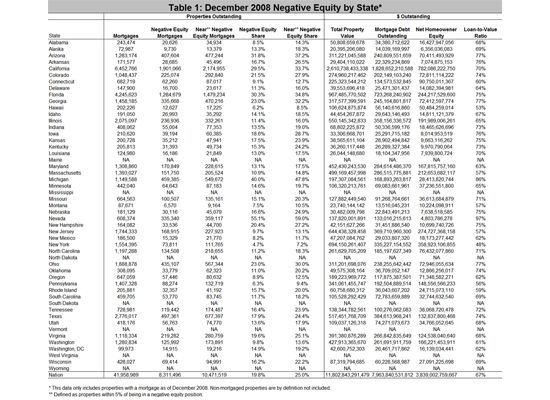

Following these two states are Arizona at 32 percent, Florida at 30 percent, and California at 30 percent rounding out the top five states with the highest negative equity (Table 1 and Figure 1). The average negative equity for the top five states was 31.9 percent. If the top five ranked states are excluded, the negative equity share for the remaining states was 13.9 percent.

In terms of the number of borrowers "underwater," California ranked first with more than 1.9 million borrowers in negative equity, followed by Florida (1.3 million) and Texas (498,000) (Figure 1).

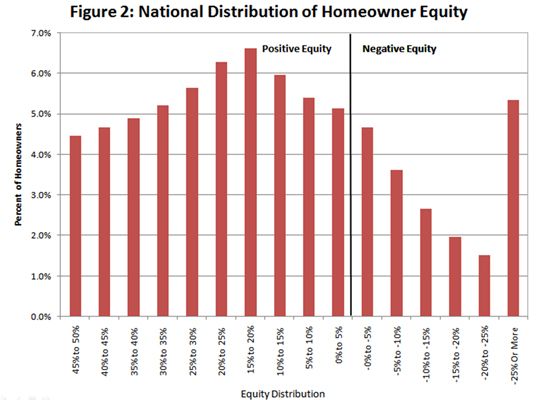

More than 2.2 million, or 5.3 percent, of all mortgaged properties are in a severe negative equity position with LTVs of 125 percent or more (Figure 2). More than 70 percent of these mortgages are in five states: California (723,000), Florida (432,000), Nevada (170,000), Michigan (128,000), and Arizona (122,000).

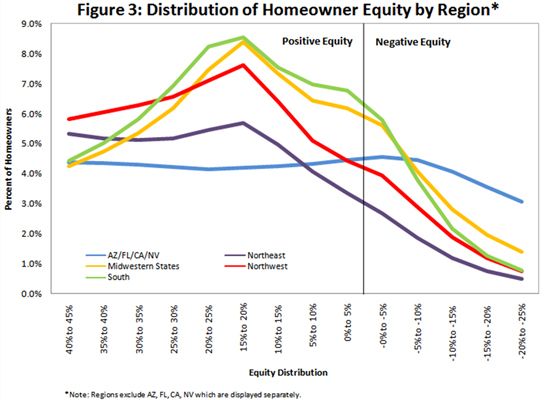

Future changes in the negative equity shares will be driven by two components, the distribution of equity and home price declines. Going forward, the largest increases in the share of negative equity will most likely occur in states that have not yet experienced deep declines.

The reason: the boom/bust states already have very high negative equity shares and incremental declines in home prices will result in smaller negative equity share increases relative to other states given the same decline in prices. This means that as prices continue to decline in 2009, the rise in the negative equity share of states outside the boom/bust regions will begin to accelerate more quickly relative to the boom/bust states.

"The accelerating share of negative equity, combined with deteriorating economic conditions, means that mortgage risk will continue to increase until home prices and the economy begin to stabilize. Going forward, the worrisome issue is not just the severity of negative equity in the 'sand' states, but the geographic broadening of negative equity that is expected to occur throughout the year," said Mark Fleming, chief economist for First American CoreLogic.

* Data and percentage point differences are rounded to the nearest tenth and may appear to affect calculations.

Click here to download a high-resolution version of this graphic.

Click here to download a high-resolution version of this graphic.

Click here to download a high-resolution version of this graphic.

Click here to download a high-resolution version of this graphic.

Methodology*:

First American CoreLogic has created state-level negative equity estimates for all single-family residential properties in the US. The data includes nearly 45 million properties with a mortgage, which accounts for more than 85% of all mortgages in the US *.

First American CoreLogic used its public record data as the source of the mortgage debt outstanding (MDO) and it includes 1st mortgage liens and junior mortgage liens in order to capture the true level of mortgage debt outstanding for each property. The current value was estimated by using the First American CoreLogic Automated Valuation Models (AVM) for every residential property in the US. The data was filtered to include only properties valued between $70,000 and $1.25 million because AVM accuracy tends to quickly worsen outside of that value range.

The amount of equity for each property was determined by subtracting the property's estimated current value from the mortgage debt outstanding. If the mortgage debt was greater than the estimated value, then the property is in a negative equity position. The data was created at the zip code level and aggregated to the state and US totals.

*Note: Only data for mortgaged residential properties that have an AVM value is presented. There are several states where the public record, AVM or mortgage coverage is very thin. Although coverage is thin, these states account for fewer than 5% of the total population of the US. The mortgage debt outstanding was not adjusted for amortization, however the majority of mortgages were originated within the last 5 years where the difference between the original mortgage debt outstanding and current mortgage debt outstanding would be small. The exclusions criteria of $70,000 and $1.25 million resulted in several million mortgaged properties being excluded from the analysis.

Articles for March 3, 2009 | Articles for March 4, 2009 | Articles for March 5, 2009

Salem-News.com:

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Vic March 5, 2009 3:13 pm (Pacific time)

Right on, Ellen ! Well said !

Jeremy March 5, 2009 1:06 pm (Pacific time)

Spitzer really blew it all by himself. He put people in prison for the same kind of behavior that he engaged in. When it came to lending practices that led to our current economic downturn, below is an archived NY Times article that shows who started the process in 1999: "Fannie Mae Eases Credit To Aid Mortgage Lending - 1999 Prophecy NYT (archives) ^ | Published: September 30, 1999 | By STEVEN A. HOLMES In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders. The action, which will begin as a pilot program involving 24 banks in 15 markets -- including the New York metropolitan region -- will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring. Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits. In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates -- anywhere from three to four percentage points higher than conventional loans." Now the rest is history, and we know who started it via the New York Times. (Excerpt) Read more at query.nytimes.com ...

Henry Ruark March 5, 2009 9:56 am (Pacific time)

Stephen: Has BEEN researched, by professionals qualified to do so. What they found was greedy operators in between home buyers and lenders, seeking out uninformed, unqualified persons to persuade into deals nobody would have approved if on the job and NOT seeking an unfair advantage. That's fact, supported by much national reporting,always disregarded by those for whom personal/group interests come first over truth and commonweal. Spitzer fate was not, as you imply, conspiracy to kill off suit, but result of work under way well prior to suit-start. Yours shadows both parties in untrue rumor-repeated, does injustice to them, you, AND this channel. IF you have proof, cite it via link to proven reliable national news channel. The rumor is known to have been originated by Far Right well motivated by chance to kill off Spitzer as new leadership.

Ellen R March 4, 2009 6:15 pm (Pacific time)

Some of the worst financial mistakes anyone can make is: Confusing equity with debt. Believing that when you take a loan out to buy real estate, you now own it, as opposed to when you were renting. The bank is the primary owner till you’ve paid off the principle amount or re-sell it to pay off what debt you still owe them. You’ve simply moved from a rent situation, to a rent-to-own situation. That when an investment has gone up in value, that your net worth has as well. Your net worth hasn’t changed until you realize either a loss or a profit on that investment. That real estate never goes down in value. All commodity values are cyclical in free market environments based on supply and demand, including real estate. And you still don’t own it after it’s paid off. The government can seize it, quickly through eminent domain or slowly through tax hikes. They can restrict its use, lowering its value. In addition for all those new cars that are on a payment plan: 100% are underwater.

stephen March 4, 2009 3:58 pm (Pacific time)

Feb 14th 2008. Elliot Spitzer had law suits, with support from most governors, against the federal government in regards to bad mortgage lending policies. 2 weeks later, the prostitution scandal against him. hmmm. It is obvious that the government, both democratic and republican were supporting these lending practices. Research it.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.