Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jul-27-2009 03:00

TweetFollow @OregonNews

TweetFollow @OregonNews

Money's Only Something You Need in Case You Don't Die Tomorrow. (Carl Fox)

Daniel Johnson Salem-News.comWhat is this money thing all about?

Courtesy: powerwealth.com |

(CALGARY, Alberta) - Americans believe, as part of their cultural mythology, that potentially anyone can get rich. Wealth really comes from three basic sources: You can win it, inherit it or be born in the right place at the right time.

None of these things are in your sphere of control, and if you know you are not in line to receive any inheritance, to believe that one of the other two will strike you, is self-delusional.

A study published by the Federal Reserve Bank of Cleveland, found that only 2.7% of Americans receive $50,000 or more in inheritance; 91.9% receive nothing. Thus, the attempt by some conservatives to eliminate inheritance taxes—which, for PR, they always call "death taxes"—would take a huge bite out of government revenues for the benefit of less than 1% of the population. So, forget inheritance as a way to get rich.

People vote their aspirations, not their reality. In a poll during the 2000 election, people were asked if they were in the top 1 percent of earners. Nineteen percent of Americans said they were in the top 1 percent and another 20 percent expect to be someday. So immediately there is more than a third of Americans who don’t oppose tax cuts for the wealthy because they think it somehow does now, or will one day, apply to them.

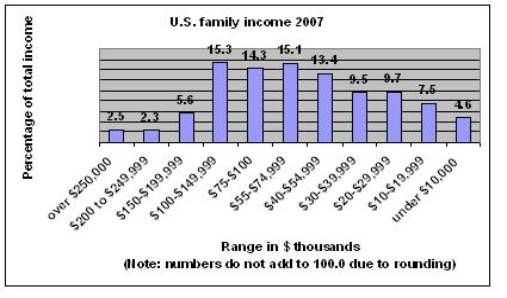

Here are the real numbers. About 10% of families have incomes greater than $150,000. Three quarters are below $75,000. The largest concentration grouping is just over half with incomes between $30,000 and $75,000.

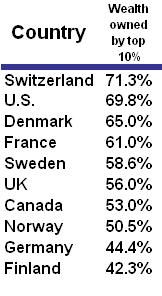

The total assets of those on the Forbes 400 list of the richest Americans is about $1.5 trillion. That’s just 400 people. The United States is the least egalitarian industrial society in the world.

Lotteries

On May 22, 2009 the third largest ever lottery prize in Canada of $50 million was won by 13 employees of ATB Financial in Edmonton, Alberta. They were, as a group, the payroll department for the company and worked on the 13th floor of the company’s head office. The employees, who write out cheques for a living, were paid about $13 an hour. (I throw out these facts for the edification of the superstitious. If the draw had been on May 13, we’d really have something to write home about.)

Every week tens of millions of people across the continent buy lottery tickets, investing a few dollars in the dream of becoming rich, a dream that must be regularly nourished and rationalized as it just as regularly fails. Some rationalize it, saying someone has to win it. This is true, just as someone has to be struck by lightning—and the chances of either striking you is miniscule, approaching zero.

And yet: In July, 1979, Chunky Woodward, the third generation scion of the 25-outlet Woodward’s department store chain, was cleaning out his wallet one day and discovered that he had won a 1-million dollar lottery a few weeks before. He bought. He won.

The Rich and the SuperRich

There’s another kind of lottery—a genetic lottery—if you’re “lucky” enough to be a son or daughter of someone on the Forbes 400 list—billionaires all.

This is where the redistribution of wealth actually happens—generation after generation. At death, fortunes tend to be divided, and often descendants don't inherit enough to stay on the list. On the list today there is only one Rockefeller, David Sr. who, at 93, will soon be passing about $3 billion on to his six children. If his fortune were equally divided, none of the recipients would be wealthy enough to make the Forbes 400.

In 1982, the list had 13 Rockefellers and thirty-three du Ponts. By 2005 all the du Ponts were gone. There is one Hearst left, William Randolph III, 60, whose fortune is estimated at about $2.4 billion. There are eight Pritzkers (Hyatt) on the list but, reports Forbes, a “dynastic carve-up [is] in full swing”.

The only other family is the Waltons (Good night, Jim-boy…sorry, wrong Waltons). There are six on the current list, all inheritors, with total wealth in the neighbourhood of $100 billion. They will be probably be on the list for two or three more generations. As Ferdinand Lundberg wrote in The Rich and the Super Rich (1968): “Today, the biggest money rewards in the American system come from simply sitting and listening to the reading of a will, which can scarcely be construed as a social contribution. Intellectually, it looks medieval.”

Being at the right place at the right time

But there is another kind of luck—that of being born at the right place at the right time. America is widely perceived, not least to its own citizens, as a land of opportunity where anyone can make a fortune, and if one doesn’t, it’s more a reflection on their lack of industry than anything else.

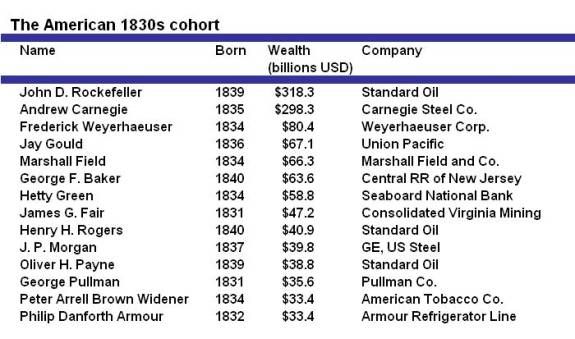

In his book Outliers (2008), Malcolm Gladwell looked at the phenomenon of men being born at the right time. Historians had compiled a list of the 75 richest people in human history, with their wealth translated into current U.S. dollars for ease of comparison. The list goes back in history to include Nicholas II of Russia, Cleopatra and Marcus Licinius Crassus of the Roman Republic.

The amazing thing about the list is that fourteen were Americans born within nine years of each other in the mid-19th century. Almost 20% of the people were born in a single generation in a single country. Here they are:

During the 1860s and 1870s, writes Gladwell, “the American economy went through perhaps the greatest transformation in its history….If you were born in the late 1840s you missed it. You were too young to take advantage of that moment. If you were born in the 1820s you were too old: your mindset was shaped by the pre-Civil War paradigm.”

Sociologist C. Wright Mills made a special study of wealth. Looking back at wealth creation from the colonial era to modern times, he came to the not surprising conclusion that those who became rich mostly came from privileged backgrounds—with one exception—the 1830s cohort. He wrote:

“The best time during the history of the United States for the poor boy ambitious for high business success to have been born was around the year 1835.”

This cohort phenomenon still exists today in the computer field.

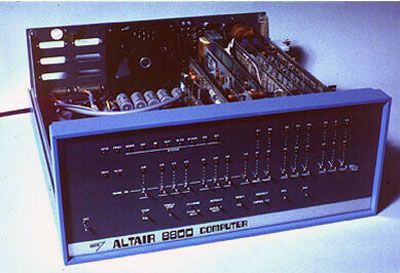

The computer revolution began with the Altair 8800 computer in 1975. If you had been born around the mid-1950s you would have been in your late teens or early twenties. The geeks of the world descended on the Altair like locusts. Those who had imagination and vision (like Bill Gates) were in a unique position to found the revolution.

Obviously for geeks and hobbyists, the Altair did not even have a monitor. Data was entered with switches and results read back by lights on the front.

In the mid 1980s the first usable applications appeared. Lotus 1-2-3, developed by Mitch Kapor (b. 1950) was the first “killer application”, making the personal computer a legitimate tool for business and going beyond the geeks and hobbyists. A few years after Lotus, dBase II appeared as the first database management program. The business world embraced the personal computer and serious money began to be made.

The late 1980s and early 1990s were a fertile field for those born in the Second Wave of the table above.

Money talks

In May 2009, six women diagnosed with breast cancer joined with the ACLU and organizations representing about 150,000 scientists, to file suit against Utah-based Myriad Genetics and the U.S. Patent and Trademark Office. The lawsuit challenges the right to patent human genes for profit.

When Lisbeth Ceriani was diagnosed with breast cancer she wanted a blood test to find out if she carried either of the two BRCA-1 and –2 genes, either of which could increase her risk of ovarian cancer by up to 50 percent. Myriad Genetics, who holds the patent on BRCA genes, refused her insurance. For her to go ahead on her own, Myriad charges $3,000 for the tests. Without the money she had no alternatives and was unable to make a decision about her future potential health.

The plaintiffs’ object is to end gene patenting. Sandra Park, an attorney with the ACLU, says, “Patents give companies total control over a gene. There is a monopoly on testing, and companies can set whatever price they want.” Legal precedent is on Myriad’s side, as nearly every suit challenging the legality of gene patenting has lost. The patent office has already issued thousands of gene patents—totalling about a fifth of all human genes. Patent law recognizes these patents of nature, which are generally considered unpatentable, as exceptions if they have been isolated from their natural state. But, argues Kenneth Berns, a U of Florida microbiologist, “when you patent genes, you put a stop to research and development on new therapies, because no one can do anything without permission.”

F for Capitalism

In his seminal book, Capitalism and Freedom (1962, 2002) conservative Nobel economist Milton Friedman argued that “a central element in the development of collectivist sentiment…has been a belief in equality as a social goal and a willingness to use the arm of the state to promote it.” What is the justification for state intervention? he asked.

“The ethical principle that would directly justify the distribution of income in a free market is, ‘To each according to what he and the instruments he owns produces.’ The operation of even this principle implicitly depends on state action. Property rights are matters of law and social convention….The final distribution of income and wealth under the full operation of this principle may well depend markedly on the rules of property adopted.” (italics added)

This last takes us to the core cause of American financial inequality.

In the late 18th century (around the same time as Adam Smith and the American Revolution) the French philosopher Marquis de Condorcet, wrote:

“It is easy to prove that wealth has a natural tendency to equality, and that any excessive disproportion could not exist, or at least would rapidly disappear, if civil laws did not provide artificial ways of perpetuating and uniting fortunes.”

The civil laws have supplied the rules of property providing artificial ways of perpetuating and uniting fortunes.

In reality capitalism is a failure system said Ferdinand Lundberg in 1968: “In business, under the American system, hundreds of thousands more have failed, generation after generation, than the few who have succeeded. If we are to judge by the preponderance of individual successes over failures or vice versa, then the American system, businesswise, is a record of steady, almost unrelieved failure. It has failure literally built into it. It is indeed a near-miracle, front page news, when anyone really makes it. This judicious observation sounds paradoxical only because it contradicts conventional propaganda.”

The conventional propaganda still prevails. As Jay Goltz wrote a two weeks ago in the New York Times:

“Some 70 percent of businesses fail within seven years, according to the Small Business Administration. In the worst cases, the result is not only business failure but also complete financial failure. What I have learned is that the damage doesn’t stop there. I share this with you as an attempt to bring some reality to the conversation about entrepreneurship. It is not just about passion and innovation and bringing your dog to work. It is also about risk, tenacity and fear. It is also about the repercussions of bad luck, bad decisions and bad economies. I know of four business owners in Chicago who have taken their own lives since the economy turned.”

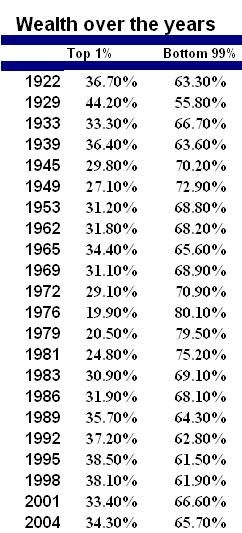

Here the table below is wealth concentration over the last 90 years, virtually unchanged and tending again to favor the wealthy. The rich lose battles but win wars.

Hope for Democracy

People are unequal. This is a neutral fact. Conservatives who argue against collectivism, socialism and statism are afraid that government will try to pass laws so there is an equality of outcome. This is not possible and is a straw man argument that Milton Friedman and his conservative cronies set up to try to head off any government activity. The outcomes in peoples lives are always going to be different, but if society were to at least try to make the starting points more equal—finding ways to eliminate the ghetto or single-parent children having to compete with middle class children on a criminally lopsided playing field—American society could perhaps reach some of its ideals.

The real societal issue is the great disparity in wealth. As Lundberg began his 1968 book:

“Most Americans—citizens of the wealthiest, most powerful and most ideal-swathed country in the world—by a wide margin own nothing more than their household goods, a few glittering gadgets such as automobiles and television sets (usually purchased on the installment plan, many at second hand) and the clothes on their backs….At the same time, a relative handful of Americans are extravagantly endowed, like princes in the Arabian Nights tales. Their agents deafen a baffled world with a never-ceasing chant about the occult merits of private property ownership…It would be difficult in the 1960s for a large majority of Americans to show fewer significant possessions if the country had long labored under a grasping dictatorship.”

The situation in America today is a difference in quantity, not quality. But, I see reason for hope. Economist John Kenneth Galbraith said in one of his last books, The Good Society (1996):

“It is an unequal contest: the rich and comfortable have influence and money. And they vote. The concerned and the poor have numbers, but many of the poor, alas, do not vote. There is democracy but in no slight measure it is a democracy of the fortunate.”

Now we can encourage what my friend and colleague Henry Ruark calls do-it-yourself democracy. Most Americans (and it is not significantly different here in Canada) have been indoctrinated into the myths of capitalism and free enterprise throughout their years of education and the mindset is maintained by the media.

But now we have the internet. Until now, to get any message out to a large number of people, you have to get them past the media gatekeepers.

John Kenneth Galbraith learned to write at Fortune magazine, under the editorship of Henry Luce, the founder of the Time-Life empire. In retrospect, Galbraith wrote:

“Self-censorship at Fortune, I learned, involved a constant calculation as to whether a particular statement—sometimes a sentence or a paragraph—was worth the predictable argument, perhaps with Luce, possibly with some frightened or zealous surrogate. Often one decided that it was not the day for a fight. Or if your conscience was compelling, you couched the favorable reference to Roosevelt or the CIO in such careful language that it would slip by, overlooking the near-certainty that it would slip by all your readers as well.”

Getting past the editors and TV producers is no longer an issue. We need to wake people up. This is not to say that they need to vote a particular way but if they vote knowledgeably and in their millions, anything is possible. I’ve long believed that the one reliable thing about democracy is that people can usually be counted on to vote against their own best interests—which explains most politics today. I’m hopeful that they can actually learn what their own best interests are and act on that knowledge.

Daniel Johnson was born near the midpoint of the twentieth century in Calgary, Alberta. In his teens he knew he was going to be a writer, which explains why he was one of only a handful of boys in his high school typing class—a skill he knew was going to be necessary. He defines himself as a social reformer, not a left winger, the latter being an ideological label which, he says, is why he is not an ideologue, although a lot of his views could be described as left-wing. He understands that who he is, is largely defined by where he came from. The focus for Daniel’s writing came in 1972. After a trip to Europe he moved to Vancouver, British Columbia. Alberta, and Calgary in particular, was extremely conservative Bible Belt country, more like Houston than any other Canadian city (a direct influence of the oil industry). Two successive Premiers of the province, from 1935 to 1971, had been Baptist evangelicals with their own weekly Sunday radio program—Back to the Bible Hour, while in office. In Alberta everything was distorted by religion.

Daniel Johnson was born near the midpoint of the twentieth century in Calgary, Alberta. In his teens he knew he was going to be a writer, which explains why he was one of only a handful of boys in his high school typing class—a skill he knew was going to be necessary. He defines himself as a social reformer, not a left winger, the latter being an ideological label which, he says, is why he is not an ideologue, although a lot of his views could be described as left-wing. He understands that who he is, is largely defined by where he came from. The focus for Daniel’s writing came in 1972. After a trip to Europe he moved to Vancouver, British Columbia. Alberta, and Calgary in particular, was extremely conservative Bible Belt country, more like Houston than any other Canadian city (a direct influence of the oil industry). Two successive Premiers of the province, from 1935 to 1971, had been Baptist evangelicals with their own weekly Sunday radio program—Back to the Bible Hour, while in office. In Alberta everything was distorted by religion.

Although he had published a few pieces (unpaid) in the local daily, the Calgary Herald, it was not until 1975 that he could actually make a living from journalism when, from 1975 to 1981 he was reporter, photographer, then editor of the weekly Airdrie Echo. For more than ten years after that he worked with Peter C. Newman (1979-1993), Canada’s top business writer (notably a series of books, The Canadian Establishment). Through this period Daniel also did some national radio and TV broadcasting with the CBC. You can write to Daniel at: Salem-News@gravityshadow.com

Articles for July 26, 2009 | Articles for July 27, 2009 | Articles for July 28, 2009

Salem-News.com:

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Anonymous March 18, 2013 8:24 am (Pacific time)

Three sources of wealth: win it, inheirit it, or be born lucky? That's it? What about earning it?

Yup, that's it. What's wealthy? We'll go by Gordon Gekko's assessment: fifty, a hundred million dollars. How could a single person possibly earn that kind of money.If you're highly educated and talented you can get a job that pays into the low seven figures (which also happens because of the third factor of being lucky) but after taxes and living expenses, you don't get to keep a lot of it. If you make a killing on the stock market, that's luck. Bill Gates, as the most famous example, was born lucky and at the right time. If he'd been born ten years earlier or later, no matter his genius, he would have missed the computer revolution entirely.

One other factor, of all the OECD nations, the U.S. has the lowest rate of social mobility, so you've got that working against you, as well.

Anonymous August 2, 2009 8:15 pm (Pacific time)

To Daniel Johnson--It is at least possible that you may have oversimplified the Estate Tax issue. While I feel no need for rich people to pass down inheritances (I think the exemption amount is $2 million, and the tax is 40% of the amount beyond the exemption--how many people leave that much?), in 2001 that tax only generated about $24 Billion, a drop in the budget bucket. Although every billion or so does help. :-) For some good information see: http://www.ask.com/bar?q=How+much+money+does+the+estate+tax+generateandpage=1andqsrc=0andab=3andu=http%3A%2F%2Farticles.moneycentral.msn.com%2FRetirementandWills%2FPlanYourEstate%2F5bigMythsAboutTheEstateTax.aspx With all of its admitted many faults, if all immigration restrictions across the entire world were eliminated, I think you know what country would be the largest destination. The USA? :-) What do people in Canada leave when they Die? Does it exceed that of the US? How was the Canadian economy doing in 2006 [before the present recession/depression]?

Daniel Johnson July 30, 2009 10:31 am (Pacific time)

Daniel: Crime. I hadn't thought of that aspect. It's not even very easy to figure amounts because it is, by nature, kept hidden. It's a whole different aspect of our society and I don't even have any ideas on how to make it relevant in terms of money.

Daniel July 30, 2009 6:44 am (Pacific time)

Daniel j you forget one of the biggest money makers crime .

Daniel Johnson July 28, 2009 9:35 pm (Pacific time)

Kyle: American society as a whole is set against itself. "United we stand, divided we fall" is an old saying that no one will deny. Yet, in America (and particularly here in Alberta) cooperation is seen as a harbinger of socialism. People are encouraged to be, and stay divided. A good example is when voters elect a conservative government, which is by definition, a government whose focus is on satisfying the business world. All across America anti-labour laws are passed and voters, almost 100% of them whom are workers, support such laws. That's people voting against their own best interest--their own best interest and that of their friends, families and neighbors.

Henry Ruark July 28, 2009 8:30 pm (Pacific time)

Kyle: "Tis the unmeandering kind, always combined with ridiculous polarization, per Alinski example of alliterated non/distraction, that does the real damage....worse than truth for some few capable of clear understandings.

Henry Ruark July 28, 2009 8:25 pm (Pacific time)

D.J: Never fear, friend, here it won't last very long...(: ?

Daniel Johnson July 28, 2009 6:08 pm (Pacific time)

Hank: I knew that if I kept on writing, that sooner or later we'd find something we could agree on. ;)

Kyle July 28, 2009 11:42 am (Pacific time)

I agree that many people will vote agaist their best interests when they receive imperfect information either about an issue or a candidate. Currently it appears that many voters are realizing both on the state and national level that they did cast their ballots, in many cases, based on bad/incomplete info. Of course we will always have the dichotomy in which one's best interest is just the opposite of anothers view on what they think is their best interest. I find that when one is reluctant to explore all info to better inform the voter, then they are not acting in the best interests of democracy. Alinsky taught the methodology of using distraction techniques, usually via the use of polorizing ridicule and meandering verbosity.

Henry Ruark July 28, 2009 9:03 am (Pacific time)

D.J.: Thank you for superb summary of essential fact about both American society and our current lifestyle, undergoing great change as unavoidable impacts of reality finally become undeniable, too. You wrote: "I’ve long believed that the one reliable thing about democracy is that people can usually be counted on to vote against their own best interests—which explains most politics today. I’m hopeful that they can actually learn what their own best interests are and act on that knowledge." That summarizes beautifully what I mean when I refer to the overwhelming past success of "the wit, wisdom and will of the American people." Fact is fact, undeniable if only understood. Fancy, even our American variety sold so inexorably over decades by a badly failing msmedia via both distortion and perversion, in the long run will gain anyone only a Great Depression-sized headache, as we are now able to observe -- but only if we "see with own eyes", then "evaluate with own mind." That inexorably includes this Comment, too !!

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.