Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Oct-17-2018 22:30

TweetFollow @OregonNews

TweetFollow @OregonNews

Oregon Taxes Fall Hardest on Poorest Families

Salem-News.com BusinessThis is one sure way to keep the poor, poor.

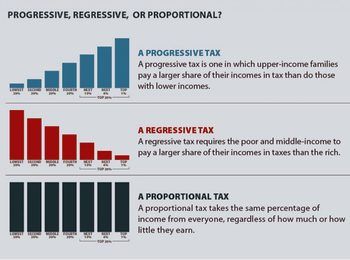

A state’s tax fairness is only partially determined by the mix of these three broad tax types. Equally important is how states design the structure of each tax. By design, some personal income taxes are far more progressive than others. |

(PORTLAND, Ore.) - Oregon’s poorest families pay more in taxes as a share of income than any group of taxpayers in the state, while the richest Oregonians pay the smallest share of any group. That is the conclusion of a new report by the Washington, D.C.-based Institute on Taxation and Economic Policy (ITEP).

“Oregon’s tax system is upside-down,” said Daniel Hauser, tax policy analyst with the Oregon Center for Public Policy, who examined the report.

“Our tax system should reduce Oregon’s record-high levels of income inequality, not widen the gap.”

Oregon is one of more than a dozen states that currently allow substantial tax breaks for the wealthy that undermine tax progress. Two of the most regressive state income tax loopholes are capital gains tax breaks (Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin) and deductions for federal income taxes paid (Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon).

The ITEP report found that Oregon's overall tax structure is regressive, with the lowest-income taxpayers paying 10.1 percent of their income in combined state and local taxes — a higher share than the 8.1 percent paid by Oregon’s richest 1 percent.

Oregon families in the middle 20 percent of taxpayers also pay a larger share of their income in taxes than the richest, at 9.1 percent.

Even so, when considered in a national context, Oregon’s tax structure still looks better than that of most other states. According to the study, Oregon has the 10th least regressive tax system among all states and the District of Columbia. Oregon’s northern neighbor, Washington, has the nation’s most regressive tax structure.

The ITEP study, Who Pays?, takes into account all major state and local taxes, including personal income taxes, corporate income taxes, sales taxes, property taxes, estate taxes, and excise taxes such as gasoline and cigarette taxes.

“Oregon’s lowest-income residents are struggling to afford rent and put food on the table. Asking these Oregonians to pay a larger share of their income in taxes than the highest-income Oregonians is a disgrace,” said Hauser.

He called on the Oregon legislature to take steps to reverse this situation by “working on both ends of the income ladder.”

“Higher income tax rates on the most well-off needs to be on the table,” said Hauser.

“This would not only help correct our unfair tax structure, but also raise revenue to invest in our schools and essential services.”

Hauser also urged lawmakers to ramp up Oregon’s Earned Income Tax Credit (EITC), a refundable tax credit that helps low-income working families. The Oregon EITC largely mirrors the federal tax credit that goes by the same name. Both in Oregon and nationally, the tax credit has enjoyed a long record of bipartisan support, said Hauser.

“A big boost to the Oregon EITC would help to correct Oregon’s flawed tax structure by lowering the taxes of those who earn the least,” said Hauser.

“More importantly, it would help struggling families make ends meet.”

The Oregon Center for Public Policy is a non-partisan, non-profit institute that does in-depth research and analysis on budget, tax, and economic issues. The Center’s goal is to improve decision making and generate more opportunities for all Oregonians.

Source: Oregon Center for Public Policy

Articles for October 16, 2018 | Articles for October 17, 2018 |

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.