Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

May-14-2009 10:25

TweetFollow @OregonNews

TweetFollow @OregonNews

Foreclosure Rates in Salem Increase

Salem-News.comDuring the past 12 months, from April 2008 to March 2009, there was a total of 3,116 foreclosure filings in Salem, or approximately 8.54 per day.

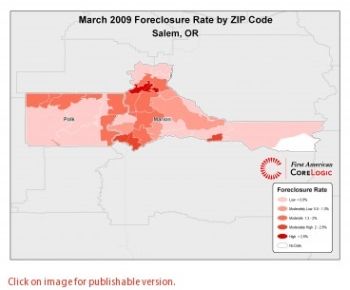

Image: First American CoreLogic |

(SALEM, Ore.) - Foreclosure rates in Salem have increased for the month of March over the same period last year, according to First American CoreLogic, the leading collector of national, state and local data on home prices, foreclosure and delinquency activity, real estate sales volume and mortgage loan activity.

According to recent data from First American CoreLogic on foreclosures for the Salem area, the rate of foreclosures among outstanding mortgage loans is 1.00 percent for the month of March, an increase of 0.50 percentage points compared to March of 2008 when the rate was 0.50 percent.*

Foreclosure activity in Salem is lower than the national foreclosure rate which was 2.10 percent for March 2009, representing a 1.10 percentage point difference.

Also in Salem, the mortgage delinquency rate has increased. According to First American CoreLogic preview data for March 2009, 3.50 percent of mortgage loans were 90 days or more delinquent compared to 1.60 percent for the same period last year, representing an increase of 1.90 percentage points.*

Foreclosure Filings

During the past 12 months, from April 2008 to March 2009, there was a total of 3,116 foreclosure filings in Salem, or approximately 8.54 per day.

That compares to the previous 12-month period of April 2007 to March 2008 when there were 1,756 foreclosure filings, or approximately 4.81 per day.

Public record foreclosure filings include the three steps in the foreclosure process beginning with the pre-foreclosure filing or Notice of Default (NOD), which typically occurs after the 90-day delinquency period, the Notice of Foreclosure Sale when the property is scheduled for auction; and the Notification of Sale filed after the property is sold at auction. If the property isn't sold at auction, it goes back to the lender and is considered Real Estate Owned (REO).

Foreclosure data for First American CoreLogic is reported based on the actual number of active mortgage loans rather than the total number of households in a given area, which provides more accurate results by removing paid-in-full mortgages from the equation.

For detailed information on foreclosures by zip code and property, visit realquest.com..

* Data and percentage point differences are rounded to the nearest tenth and may appear to affect calculations.

Source: First American CoreLogic

ABOUT FIRST AMERICAN CORELOGIC

Articles for May 13, 2009 | Articles for May 14, 2009 | Articles for May 15, 2009

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.