Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Feb-09-2010 22:46

TweetFollow @OregonNews

TweetFollow @OregonNews

President Obama Should Stop Home Foreclosures

William K. Barth Salem-News.com“We haven’t yet found a way of dealing with this……” -Assistant Treasury Secretary Herbert M. Allison Jr. on home mortgage-loan modifications

The reality of home ownership today for many Americans. |

(LOS ANGELES) - Early in his term of office, President Obama set the standard by which voters should judge his administration, saying it would be tested by how successful it had been in ending the nation’s economic downturn.

Republican victories in New Jersey, Virginia and, more recently, Massachusetts, as well as the failure of congressional Democrats to pass President Obama’s health reform legislation, all go to illustrate that voters are dissatisfied with the Democrats, whom they perceive as ineffective.

The most stunning example of Democratic failure since President’s Obama inauguration last year has been their inability to stop home foreclosures, which are projected to effect 19 million homeowners by the end of 2010.

In his recent State of the Union Address, President Obama made clear how he intends to resolve the home mortgage foreclosure crisis – namely, by ignoring it. He offered no options for distressed homeowners, aside from their securing conventional mortgage loan refinancing at lower interest rates.

However, because of the depressed housing market, millions of homeowners hold mortgage debts greater than the value of their homes; they are, as industry analysts describe it, underwater. Deutsche Bank had projected that 25 million, or 48 percent, of all homeowners will be ‘underwater’ in their mortgages next year.

White House Photo, Samantha Appleton, 2/5/10 |

Furthermore, diminished home values make conventional bank refinancing impossible, because, sadly, the Federal government’s TARP bank-rescue program was never intended to assist homeowners to modify their mortgage terms.

Otherwise, it is difficult to understand how the Obama administration expects the economy to recover, since high mortgage payments, when combined with declining home values, have further depressed the housing market that triggered the economic recession in the first place. Underwater homeowners are faced with a devil’s dilemma, because they cannot afford their inflated mortgage payments, nor sell their homes at prices that will permit them to satisfy those homes’ mortgage debts.

This leaves homeowners with effectively two options: namely, resorting to so-called short-sales (i.e. convincing the lender to accept a loss when the home is sold for less than the mortgage owed), or, worse, foreclosure, which is a process that affects an owner’s credit worthiness, similar to legal bankruptcy.

The result of all this is that millions of homeowners will not only suffer eviction from their homes, but also ruin their credit, which curtails their consumer spending and further damages the prospect of general economic recovery. Moreover, the economic ripple effects of foreclosures cause neighborhood home values to plummet while at the same time diminishing municipal tax bases.

So far, President Obama’s Home Affordable Modification Program (HAMP) has assisted only 31,000 homeowners to modify their mortgages, whilst millions more remain on the brink of foreclosure.

The President’s meager housing efforts are faulty in their conception, since homeowners living in high-priced housing markets in states like California, Massachusetts and New York are ineligible for the HAMP program, since, according to the means test, they hold mortgages priced above the program’s upper limit.

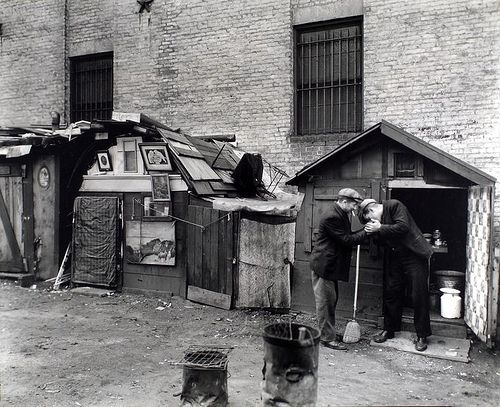

Not to say that people didn't have houses during the Depression... (michaelbabbish.com) |

President Obama’s beleaguered housing strategy is perplexing, given that previous Democratic Presidents created successful housing programs. For example, Presidents Franklin Roosevelt and Harry Truman assisted millions of working-class families in achieving home ownership by creating the Federal Housing Administration (FHA) mortgage insurance program, as well as the FHA-VA program, which helped build military housing and assisted millions of returning war veterans to buy new homes. Although the homeownership rate fell last year to 67.3 percent, homeownership is still close to its all time high of 68.1 percent in 2001.

During the Great Depression era, only four in ten American households owned homes, and America was a nation of renters. In the 1940s, mortgage loan terms were limited to 50 percent of the property's market value, with a repayment schedule spread over three to five years and ending with a balloon payment, making mortgage terms difficult for most homebuyers to meet.

The FHA encouraged lenders to create affordable 30-year mortgages, by insuring lenders against mortgages lost to default. The FHA has insured over 34 million properties since its inception in 1934. Furthermore, the FHA was also good politics, as working-class families who became homeowners remained loyal to the Democrats thereafter.

This lesson is not lost on all politicians. For example, Hilary Clinton, during her presidential nomination campaign, appeared to offer a bolder, macro-economic approach for solving the foreclosure crisis. Clinton supported the idea of placing a moratorium on all home foreclosures, to stabilize the decline of home values whilst encouraging lenders to modify mortgage terms to homeowners. Even Republican candidates such as John McCain got in on the act, promising to re-set mortgages to the lowered market-value of homes in order to assist underwater homeowners.

Inexplicably, the Obama Administration has not fully utilized the FHA, and other programs like it, despite the fact that these programs have been used frequently over the decades to assist both homeowners and lenders overcome difficult housing-market challenges. Creative financing ideas abound about how to assist lenders to modify home mortgages, such as ‘equity give-backs’, which permit lenders to share in a home’s appreciation when it is resold.

Alternatively, there is the idea of having the FHA serve as the insurer of last resort (its current role), so as to protect lenders against losses that result from their modifying the terms of a homeowner’s mortgage. In short, existing Federal programs work in partnership with lenders to assist homeowners escape mortgages they can no longer afford by transitioning them into a new housing situation, without having to resort to obnoxious public policy solutions such as default, foreclosure, or bankruptcy, all of which can only further imperil the recovery.

Sadly, the Obama administration has left distressed homeowners with few alternatives. This will make it difficult to solve our current economic downturn, because, as in the last Great Depression, housing construction jobs have disappeared in the depressed housing markets. It is bad enough that President Obama and a Democratic Congress failed to agree on even a weakened version of health care reform.

If the home foreclosure crisis continues unattended, it will transform the stream of Republican state-wide victories into a tsunami of voter discontent headed directly towards the incumbents in Washington DC, namely, President Obama and congressional Democrats.

Dr. William K. Barth, a graduate of the University of Oxford, Oxford, UK, is a lawyer who researches the politics of minority rights. Dr. Barthʼs doctoral thesis entitled On Cultural Rights: The Equality of Nations and the Minority Legal Tradition, was recently published by Martinus Nijhoff. Prior to initiating his research in Oxford, Dr. Barth served as a senior lawyer for the U.S. Department of Housing and Urban Development. He received his Master of Public Administration Degree from Harvard Universityʼs John F. Kennedy School of Government (ʼ86) and his Juris Doctor from Loyola University School of Law (ʼ79). He has been a member of the California State Bar in good standing since 1979. He writes a blog for the Huffington Post.

Dr. William K. Barth, a graduate of the University of Oxford, Oxford, UK, is a lawyer who researches the politics of minority rights. Dr. Barthʼs doctoral thesis entitled On Cultural Rights: The Equality of Nations and the Minority Legal Tradition, was recently published by Martinus Nijhoff. Prior to initiating his research in Oxford, Dr. Barth served as a senior lawyer for the U.S. Department of Housing and Urban Development. He received his Master of Public Administration Degree from Harvard Universityʼs John F. Kennedy School of Government (ʼ86) and his Juris Doctor from Loyola University School of Law (ʼ79). He has been a member of the California State Bar in good standing since 1979. He writes a blog for the Huffington Post.

Dr. William K. Barth's book link is: brill.nl/default.aspx?partid=210&pid=30599

You can visit his blog page at this address: thebarthreport.com/

Articles for February 8, 2010 | Articles for February 9, 2010 | Articles for February 10, 2010

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

wkbarth February 14, 2010 1:13 pm (Pacific time)

Dear Mercury 213 - I stand corrected. I was using old numbers. You are correct that 66000 permanent mods under HAMP are now approved. I stand corrected and my apologies for using the older statistic.

Hank Ruark February 11, 2010 8:15 am (Pacific time)

Several other experts, academic and professional, have advised those with homes "underwater" simply to "wlk away" --abandon deal to the "free market" and maintain independence by that act. What's take out there on that action ? Moral ? Ethical? Legal ? What are the sure and the possible conseaquences ? What will such action end up doing to "free market", not only in housing but generally, if those abused/manipulated (whichever is fact !) are to act by simple refusal to keep on keeping on... ??

Dr William K Barth February 10, 2010 4:31 pm (Pacific time)

Dear Mercury213, Thank you for your question. The total number of 31,000 permanent modifications (trial modification numbers are much higher) as reported by CEO of Ing Direct USA, Arkadi Kuhlman, just recently in the New York Times. All the best, William Barth

jimmy February 10, 2010 2:53 pm (Pacific time)

Jim Arvin... Agree with you 100%! I'm busting my ass to make my payments on my house...why would anyone help me out, I'm just middle class. Looking at Dr. Barth's extensive history at suckling at the governments teat, it's no wonder he is advocating more of the same. Sadly, there is no "change" in the current administration, Czar Barak is breaking campaign promises just as fast as the last guy.

Jim Arvin February 10, 2010 9:45 am (Pacific time)

Yeah, and President Obama should buy everyone a pony, too. Here's a mortgage plan for you: 1) Everybody pays THEIR OWN mortgage. 2) Those who can't pay, or don't feel like paying their mortgage can RENT. 3) Banks and speculators who lent money to people who can't pay, or don't t feel like paying their mortgages can foreclose or not, as it suits them.

Mercury213 February 10, 2010 2:30 am (Pacific time)

So far, President Obama’s Home Affordable Modification Program (HAMP) has assisted only 31,000 homeowners to modify their mortgages, whilst millions more remain on the brink of foreclosure." Where did this number come from. While still dismal, I was of the understanding that 66,000 rec'd permanent mods under HAMP as of Dec09.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.