Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Apr-29-2010 17:23

TweetFollow @OregonNews

TweetFollow @OregonNews

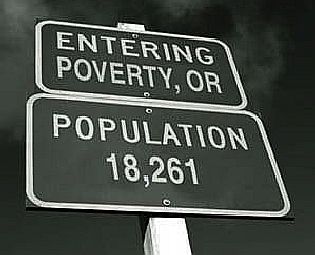

Oregon Still Among Minority of States That Tax Poor Families' Wages

Salem-News.comOCPP weighs in on Oregon's taxing of the poor.

In Oregon, a nearly poor family of four -- a family with income at 125 percent of poverty, or just $27,434 -- paid the fourth highest income tax in the nation, $764. |

(SILVERTON, Ore.) - Oregon remains among a minority of states that tax the income of poor families and its tax is among the highest in the nation, according to a report released today by the Washington, D.C.-based Center on Budget and Policy Priorities (CBPP).

"Taxing the work effort of poor families is counterproductive," said Joy Margheim, policy analyst with the Oregon Center for Public Policy, who examined the report. "Poor, working families and our state as a whole would be better off if such families could devote more of their modest income to food, child care, transportation and other basic needs."

According to the report, in 2009 Oregon income taxes kicked in at $19,800 for a married couple with two children -- about $2,150 below the poverty line for a family that size. Of the 42 states (counting the District of Columbia as a state) with an income tax in 2009, only nine other states imposed income taxes on four-person families with less income. The vast majority of states -- 29 of the 42 with income taxes -- do not tax the poor.

A two-parent family of four living at the poverty line with just $21,947 in income had to pay $200 in Oregon income taxes in 2009, the fifth highest amount among states for a family of four at that income level, Margheim said. A nearly poor family of four -- a family with income at 125 percent of poverty, or just $27,434 -- paid the fourth highest income tax in the nation, $764.

"The bottom line," Margheim said, "is that Oregon not only sets the level for having to start paying income taxes much lower than most other states, but it also imposes one of the heftier income tax bills on low-income families once they rise above that income level."

By contrast, many states either levy no income tax on poor working families or even offer what is essentially a negative income tax, where the families get more money back than they pay in. Those states "offer a hand up to working poor families," Margheim said.

The policy analyst said that the report's findings confirm the need for a "robust improvement" to Oregon's Earned Income Tax Credit (EITC). The Oregon EITC is a refundable tax credit for low-income families who work. It's calculated as a share -- currently 6 percent -- of the federal EITC. "A boost to the state's EITC is the most efficient and targeted way for Oregon to raise the income tax threshold and end the practice of taxing the work effort of working poor families," Margheim said. She noted the example of North Carolina, which increased its EITC in 2009 and lifted its income tax threshold above the poverty line for a family of four.

OCPP said that Oregonians for Working Families -- a coalition of over 95 health and human service organizations, labor groups, businesses and local governments -- plans to push for a significant increase in the state EITC next year.

===================================================

Source: The Oregon Center for Public Policy, a nonpartisan research institute that does in-depth research and analysis on budget, tax and economic issues. The Center's goal is to improve decision making and generate more opportunities for all Oregonians.

Articles for April 28, 2010 | Articles for April 29, 2010 | Articles for April 30, 2010

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Vic April 30, 2010 4:02 pm (Pacific time)

Good points, Ersun...and although I do not smoke or like cigarettes, it is amazing to me how a pack of Marlboros or Camels down here in Mexico can cost $1.50 when the same pack would be $5 in the states. Thats a lot of tax.

Ersun Warncke April 30, 2010 7:30 am (Pacific time)

For the anon commentators and anybody else who cares about tax fairness, let me raise a few points:

1) In Oregon, income tax is just the beginning. The State's gambling and liquor monopolies, along with cigarette taxes are huge taxes on the poor. Fees, fines, bail, etc, are a whole other class of taxes.

2) The income of foreign banks is exempt from taxation in this State.

Does that sound fair to you?

Hank Ruark April 30, 2010 9:05 am (Pacific time)

Best possible answer for UN- informed or some malignly MIS- informed is strong action now forthcoming from NINETY-FIVE responsible groups. Following on recent remedy for SEVENTY YEARS neglect in "$10 Minimum" corporate tax- joke and (very) slight further adjustment in corporate-take state-tax/flow, there may be some hopeful progress now in sight. Stats state 10% of populace suffers from mental problems. Why do so many offer so much guffy-stuff on Internet ? Is there psychological sweet in seeing false-name foolish- fancy flourished publicly ?? True/ID on record can and should be demanded to offset obvious abuse of public dialog generally, in defense of true responsibilities inherent in our famed First Amendment. One-time sign-on now under quiet consideration by strong pressures on FCC.

Joe April 29, 2010 9:01 pm (Pacific time)

You don't care for the poor either. They get the EIC. It's real. Stop egging people on.

Editor: Never gonna' happen Joe, only that isn't what we do. The truth hurts I know, but we will always be here to share it. Do you know anything about this thing that used to exist called the middle class? People used to be able to live in America when one person in the family worked. The crappy shareholders have driven the poor into the ground and we are here to be their voice and we offer no apologies. I don't expect everyone to understand, or to be able to get past their own values that keep them oriented toward themselves and not toward others. If you knew anything about me at all then at the very least you would know that your statement above is far from true.

Hank Ruark April 29, 2010 7:49 pm (Pacific time)

What is truly typical here is this fat-cat selfish cant thrown into public dialog where responsibility, accountability and personal credibility is hidden by full intent via cowardly anonymity. For this "opinion", in press side daily, one has to sign name and be fully identified. Which is what any ethical person would wish, if indeed the "opinion" is worth time to read it.

Anonymous April 29, 2010 6:06 pm (Pacific time)

This is typical bogus info coming from these radicals. Just take the earned income credit to start with. Always trying to cause hate between different socioeconomic groups. People at this income level pay very little income tax if at all, and always get more back than they ever put in by a significant margin.

Editor: Yeah, caring for poor people is a real radical act isn't it? Are you worried about the poor and oppressed being encouraged to finally take a stand and rise up against the fat cats that rape and pillage their nation, forcing ridiculous laws down their throats that favor insurance companies and big pharma over the lives of the poor? Is it that you think people will finally reach the breaking point and take what the rich have stolen from them by force? Yup, pretty concerning, I agree.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.