Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Mar-31-2009 13:27

TweetFollow @OregonNews

TweetFollow @OregonNews

Foreclosure Rates in Salem Increase

Salem-News.comThe mortgage delinquency rate has also increased in Salem.

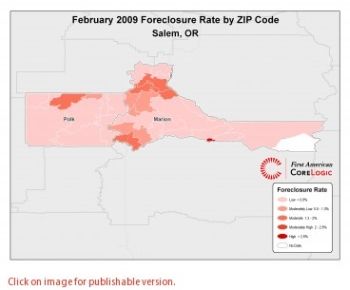

Courtesy: First American Core Logic |

(SALEM, Ore.) - Foreclosure rates in Salem have increased for the month of February over the same period last year, according to First American CoreLogic, the leading collector of national, state and local data on home prices, foreclosure and delinquency activity, real estate sales volume and mortgage loan activity.

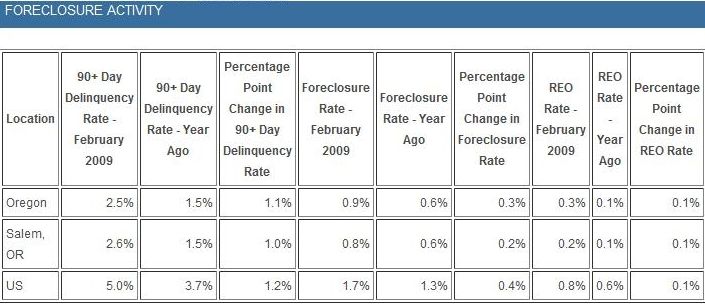

According to recent data from First American CoreLogic on foreclosures for the Salem area, the rate of foreclosures among outstanding mortgage loans is 0.8 percent for the month of February, an increase of 0.2 percentage points compared to February of 2008 when the rate was 0.6 percent.*

Foreclosure activity in Salem is lower than the national foreclosure rate which was 1.7 percent for February 2009, representing a 0.9 percentage point difference.

Also in Salem, the mortgage delinquency rate has increased. According to First American CoreLogic preview data for February 2009, 2.6 percent of mortgage loans were 90 days or more delinquent compared to 1.5 percent for the same period last year, representing an increase of 1.0 percentage points.*

Foreclosure data for First American CoreLogic is reported based on the actual number of active mortgage loans rather than the total number of households in a given area, which provides more accurate results by removing paid-in-full mortgages from the equation.

For detailed information on foreclosures by zip code and property, visit realquest.com.

* Data and percentage point differences are rounded to the nearest tenth and may appear to affect calculations.

Methodology:

The First American Core Logic Loan Performance HPI incorporates more than 30 years worth of repeat sales transactions, representing more than 45 million observations sourced from First American Core Logic's industry-leading property information database.

Loan Performance HPI provides a multi-tier market evaluation based on price, time between sales, property type and loan type (conforming vs. nonconforming).

The Loan Performance HPI is a repeat-sales index that tracks increases and decreases in sales prices for the same homes over time, which provides a more accurate "constant-quality" view of pricing trends than basing analysis on all home sales.

The Loan Performance HPI provides the most comprehensive set of monthly home price indices and median sales prices available covering 7,649 ZIP codes, 958 Core Based Statistical Areas (CBSA) and 676 counties located in all 50 states and the District of Columbia. Full-month October and through mid-month November 2008 state and top CBSA-level data can be found at loanperformance.com/products/hpi.aspx.

Source: FIRST AMERICAN CORE LOGIC

Articles for March 30, 2009 | Articles for March 31, 2009 | Articles for April 1, 2009

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.