Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jul-16-2018 10:10

TweetFollow @OregonNews

TweetFollow @OregonNews

How to Determine if You Should Become an Investor Right Now

Salem-News.com BusinessThe best results come from informed decision-making.

|

(SALEM, Ore.) - Casual investing is not a new phenomenon. If you are a regular income earner, then you probably know that you should be saving money and investing for your future.

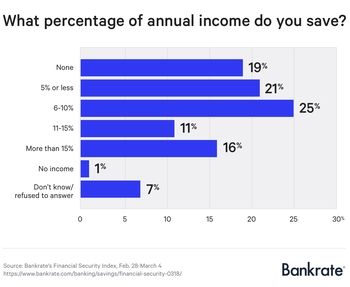

Unfortunately, Americans don’t save as much as they should, neither do they invest with specific goals in mind.

If you are conflicted about whether you should become an investor, here are several points that will help you decide:

You are Under 35 and Have a Steady Job

If you are a young person with a reliable stream of income, then there’s really no reason why you shouldn’t become an investor. Your 30s are actually the best years to invest. You are young enough to work for decades to come to make up for a loss, just in case. And you are old enough to understand the risks of various investments (as opposed to an 18-year-old college student per se).

Income earners should save a portion of their income for emergencies and retirement. It’s not difficult to allocate a minor segment of your income towards investments either. You can invest on the cheap at OTC markets, though with some considerable risk, or take the safe route and put all your money in a federally insured savings bank.

Therefore, if you are an income earner, then you are certainly eligible to become an investor.

When You are Looking for Supplemental Income

Investing is a great way to earn supplemental income instead of working a second job or earning measly wages freelancing online. If you are willing to take on some risk, you can start trading stocks and other assets to earn supplemental income. If you invest in blue chip stocks, you can earn extra income annually or quarterly via dividends.

Of course, returns are not guaranteed when it comes to investing. However, if you are willing to educate yourself on how the market works, then you can make smart investment choices and avoid the common pitfalls that lead to losses. You can earn better returns than with a second or third job.

You Don’t Need to Cash in On Returns Right Away

Most average income earners wonder if investing is a great way to earn money for down payments for houses, vehicles or other essential expenses.

If you need money in less than a year, then investing will not be a good choice. You are better off saving instead. However, if you want to save up for retirement 20 or more years down the line, then investing is a great choice.

The value of investments is often evident in the long-term, not the short term. Because the market is volatile, short-term investments can quickly lose value.

The same is not always true with long-term options. You can start investing now in stocks and bonds benefit from the compounding interest rates that pay off years in the future.

In general, if you are willing to learn and balance risk versus reward well, you might be a great candidate to become an investor. Starting early in your twenties or thirties is quite crucial to allow investments to mature. You would also have more time to gain experience.

Source: Salem-News.com Special Features Dept.

Articles for July 16, 2018 | Articles for July 17, 2018

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.