Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jul-07-2010 17:49

TweetFollow @OregonNews

TweetFollow @OregonNews

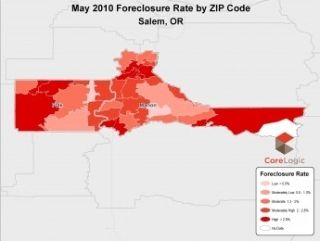

Foreclosure Rates in Salem Increase

Salem-News.comThe latest in Salem, Oregon real estate trends.

|

(SALEM, Ore.) - Foreclosure rates in Salem have increased for the month of May over the same period last year, according to CoreLogic.

According to newly released data from CoreLogic on foreclosures for the Salem area, the rate of foreclosures among outstanding mortgage loans is 2.14 percent for the month of May, an increase of 0.64 percentage points compared to May of 2009 when the rate was 1.50 percent.*

Foreclosure activity in Salem is lower than the national foreclosure rate which was 3.15 percent for May 2010, representing a 1.01 percentage point difference.

Also in Salem, the mortgage delinquency rate has increased. According to CoreLogic data for May 2010, 5.77 percent of mortgage loans were 90 days or more delinquent compared to 3.93 percent for the same period last year, representing an increase of 1.84 percentage points.*

Data and percentage point differences are rounded to the nearest tenth and may appear to affect calculations.

| Location | 90+ Day Delinquency Rate May 2010 | 90+ Day Delinquency Rate May 2009 | Percentage Point Change in 90+ Day Delinquency Rate | Foreclosure Rate May 2010 | Foreclosure Rate May 2009 | Percentage Point Change in Foreclosure Rate | REO Rate May 2010 | REO Rate May 2009 | Percentage Point Change in REO Rate |

|---|---|---|---|---|---|---|---|---|---|

| Oregon | 5.64% | 3.87% | 1.78% | 2.23% | 1.49% | 0.74% | 0.50% | 0.32% | 0.18% |

| Salem, OR | 5.77% | 3.93% | 1.84% | 2.14% | 1.50% | 0.64% | 0.48% | 0.28% | 0.20% |

| US | 8.22% | 6.29% | 1.93% | 3.15% | 2.56% | 0.59% | 0.65% | 0.56% | 0.09% |

Source: CoreLogic.

| Salem, OR | 90+ Day Delinquency Rate | Foreclosure Rate | REO Rate |

|---|---|---|---|

| May 2010 | 5.77% | 2.14% | 0.48% |

| April 2010 | 5.74% | 2.10% | 0.46% |

| March 2010 | 5.70% | 2.04% | 0.44% |

| February 2010 | 5.74% | 2.00% | 0.42% |

| January 2010 | 5.68% | 2.00% | 0.42% |

| December 2009 | 5.59% | 1.85% | 0.40% |

| November 2009 | 5.43% | 1.71% | 0.38% |

| October 2009 | 5.24% | 1.71% | 0.39% |

| September 2009 | 5.04% | 1.70% | 0.38% |

| August 2009 | 4.76% | 1.65% | 0.33% |

| July 2009 | 4.48% | 1.66% | 0.31% |

| June 2009 | 4.15% | 1.54% | 0.29% |

| May 2009 | 3.93% | 1.50% | 0.28% |

| April 2009 | 3.67% | 1.45% | 0.27% |

| March 2009 | 3.41% | 1.28% | 0.26% |

| February 2009 | 3.15% | 1.09% | 0.29% |

| January 2009 | 2.88% | 0.98% | 0.28% |

Source: CoreLogic.

Data Notes and Definitions

90+ Day Delinquency Rate: This measures the percentage of loans that are more than 90 days delinquent including those in foreclosure and REO (real estate owned).

Foreclosure Rate: This measures the percentage of loans in some stage of foreclosure including 90+ delinquencies through properties sold at auction. This does not represent the number of new foreclosure filings as provided by other data companies, but rather the current stock, or inventory, of loans in the foreclosure process which offers a comprehensive view of foreclosure trends.

REO (Real Estate Owned) Rate: This measures the percentage of loans not sold at auction which are then returned to the lender. Foreclosure data for CoreLogic is reported based on the actual number of active mortgage loans rather than the total number of households in a given area, which provides more accurate results by removing paid-in-full mortgages from the equation.

Source: CoreLogic. The data provided is for use only by the primary recipient or the primary recipient's publication. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a real estate data and analytics company. For questions, analysis or interpretation of the data contact Lori Guyton at lguyton@cvic.com or Bill Campbell at bill@campbelllewis.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

Articles for July 6, 2010 | Articles for July 7, 2010 | Articles for July 8, 2010

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Anonymous July 8, 2010 8:56 am (Pacific time)

I wonder what tax increase measures #66 and #67 had on the foreclosure rate? Seems that more businesses of all sizes along with their jobs went poof, but still we have an increaing revenue shortfall. Probably a few months before election time we shall see money from the failed stimulus bill (the majority of that failed bill's funds are still available) gets flushed around for political leverage, but it just delays the inevitable. Liberals never learn, because basically the vast majority have no experience running a "successful" business. We are in this mess because of the democrats, and their continued trend of increasing fees and taxes. Just look at the historical record. Thank God, they will soon be out of power.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.