Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Feb-19-2008 15:29

TweetFollow @OregonNews

TweetFollow @OregonNews

Where Will the Pain Be?

Salem-News.comOCPP’s subprime maps can help legislators target education about foreclosure scams addressed by HB 3630.

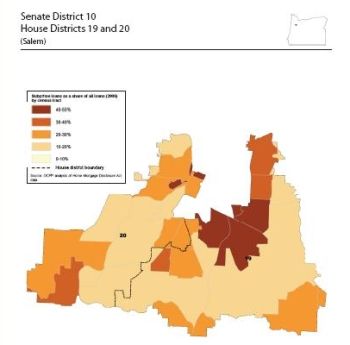

This is the map of the Salem area. Courtesy: OCPP |

(SILVERTON, Ore.) - The U.S. home loan market is failing in spectacular fashion. A housing bubble created partly by lax consumer protection laws has burst, sending delinquencies and foreclosures soaring and hobbling the national economy.

While Oregon has so far avoided the worst of the crisis, recent trends are worrying. Home prices have turned negative in a rising share of neighborhoods and delinquencies are surging. Oregon’s housing troubles may only get worse.

Driving the housing market’s collapse are subprime loans, high-cost loans often issued to borrowers with impaired or no credit history. As of the third quarter of 2007, payment was past due on more than one in 10 subprime loans in Oregon, and the delinquency rate on these loans was rising.

Policymakers and elected leaders can best ameliorate the impact of rising subprime delinquencies if they know where subprime loans are concentrated. For instance, the Oregon Legislative Assembly is debating HB 3630, which would establish new consumer protections for borrowers facing foreclosure.

If the bill becomes law, legislators and the Oregon Department of Consumer and Business Services could target public education efforts about the new law in neighborhoods at higher risk for foreclosures.

But where are the potential trouble spots? OCPP has developed maps showing the concentration of subprime loans by census tract for each state legislative district. To see the PDF file featuring the maps, visit: OCPP Maps

Among legislative districts with the highest share of subprime mortgage originations in 2006 were those of legislative leaders: Senate President Peter Courtney (36.9 percent), Senate Republican Leader Ted Ferrioli (31.4 percent), and House Speaker Jeff Merkley (35.7 percent). Even in the district with the lowest share of subprime loans, Representative Sara Gelser’s House District 16, one in eight residents who took out a home loan in 2006 (13.0 percent) received a subprime loan.

Of course, factors besides subprime loans impact the foreclosure rate. These include declining home prices, a weak local economy, or a high concentration of risky mortgage products besides subprime loans.

But with subprime loan delinquencies already high and rising, census tracts in which these loans are concentrated should concern policymakers and those seeking to ameliorate the problem through public education and other means.

Source: Oregon Center for Public Policy

Articles for February 18, 2008 | Articles for February 19, 2008 | Articles for February 20, 2008

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

M Gomez February 20, 2008 6:50 am (Pacific time)

It seems to me that those loans made to people with poor credit backgrounds as well as those who were simply investing and not living in the homes as their primary residence are the reason this housing problem is happening, plus other factors also. I believe that this will correct itself as long as the government does not take any foolish actions. Keeping taxes low, or even reducing them for a while will help. Unfortunately those who make their living that goes along with housing construction will have to look for other types of work. A massive training program for these people will be needed. Where the funding for this will come from is any one's guess. Low interest loans could be one way to go I guess, but we must keep the taxes low, even cut them. This has proven in the past as the best way to generate good long term revenue, in my opinion. We must also either stop the ethanol program for it will drive food prices out of control, and that's where the inflation problem will impact our poorest of people. If the farmers increase their corn growing acreage for livestock feed, it will still go up in price because all corn prices will be driven by the ethanol corn market. Ethanol and giving loans to unqualified individuals has been a big whammy to our economy, as well as oil prices. Maybe drilling in Alaska and building more refineries will help? Not a popular idea, but we need energy as we still develop other sources in the meantime.

Equality February 19, 2008 3:51 pm (Pacific time)

As a disabled war veteran I pay almost 9% interest rate. The illegal aliens across the street (9 living in the house) are paying around 5%. Welcome to Little Tijuana!

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.