Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Aug-13-2009 16:53

TweetFollow @OregonNews

TweetFollow @OregonNews

New Data Shows Nearly One-Third of all Mortgages Underwater

Salem-News.comSalem Shows 24.55 Percent of Mortgages in Negative Equity.

Source: First American Core Logic |

(SALEM, Ore.) - NEW DATA SHOWS NEARLY ONE-THIRD OF ALL MORTGAGES UNDERWATER Salem Shows 24.55 Percent of Mortgages in Negative Equity

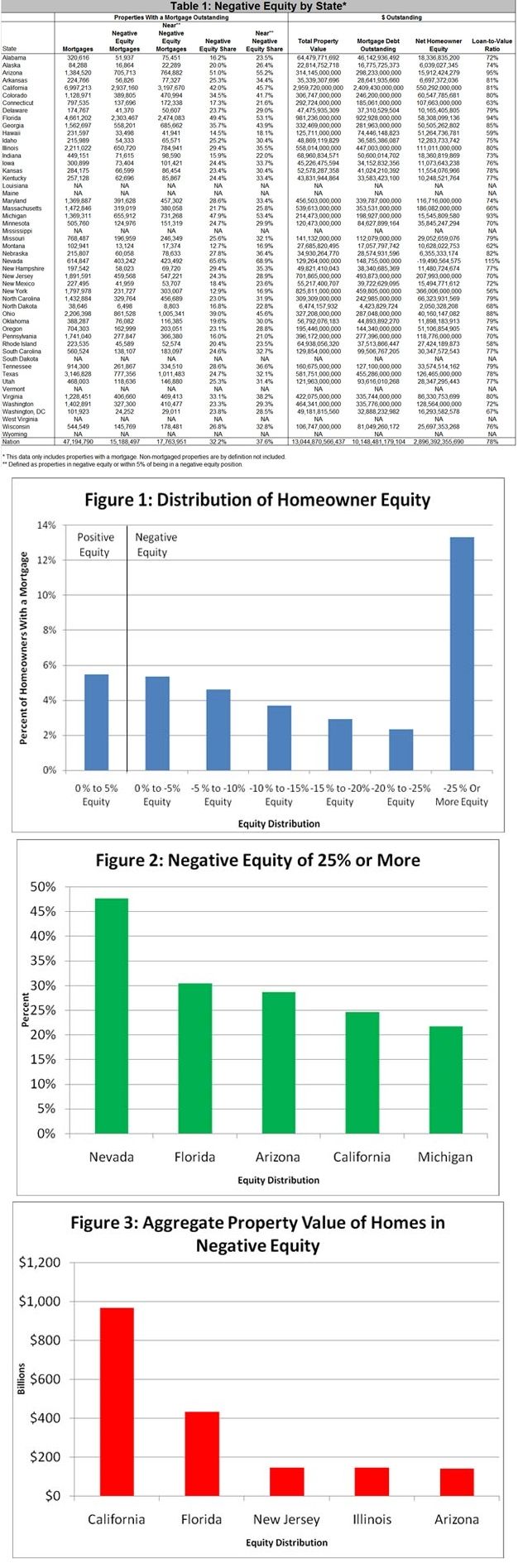

More than 15.2 million U.S. mortgages, or 32.2 percent of all mortgaged properties, were in negative equity position as of June 30, 2009 according to newly released data from First American CoreLogic. June's negative equity share was slightly lower than the 32.5 percent as of the end of March 2009 and it reflects the recent flattening of monthly home price changes. As of June 2009, there were an additional 2.5 million mortgaged properties that were approaching negative equity. Negative equity and near negative equity mortgages combined account for nearly 38 percent of all residential properties with a mortgage nationwide.

In Salem, 16,926, or 24.55 percent of all properties with a mortgage, are in negative equity. A total of 21,268 mortgages, or 30.85 percent, are in near negative equity or negative equity.

The aggregate property value for loans in a negative equity position was $3.4 trillion, which represents the total property value at risk of default. In California, the aggregate value of homes that are in negative equity was $969 billion, followed by Florida ($432 billion), New Jersey ($146 billion), Illinois ($146 billion) and Arizona ($140 billion). Los Angeles had over $310 billion aggregate property value that was in a negative equity position, followed by New York ($183 billion), Miami ($152 billion), Washington, D.C. ($149 billion) and Chicago ($134 billion). In Salem, $3,449,751,364 total property value was at risk of default.

Negative equity, often referred to as "underwater" or "upside down," means the borrower owes more on their mortgage than the home is worth. Near negative equity is when mortgages are within five percent of being in a negative equity position. Negative equity can occur because of a decline in value, an increase in mortgage debt or a combination of both.

The distribution of negative equity is heavily skewed to a small number of states as three states account for roughly half of all mortgage borrowers in a negative equity position. Nevada (66 percent) had the highest percentage where nearly two-thirds of mortgage borrowers had negative equity. In Arizona (51 percent) and Florida (49 percent) half of all mortgage borrowers had negative equity. Michigan (48 percent) and California (42 percent) round out the top five states.

The top five states' negative equity share was 47 percent, compared to 25 percent for the remaining states. In numerical terms, California (2.9 million) and Florida (2.3 million) had the largest number of negative equity mortgages, accounting for 5.2 million or 35 percent of all negative equity loans. Ohio (862,000), Texas (777,000) and Arizona (706,000) were also among the top five ranked states for the number of loans with negative equity.

"Negative equity continues to be the dominant driver of the mortgage market because it leads to foreclosures in the event a borrower experiences some kind of economic shock: job loss, illness or other adverse situation. Given that negative equity did not increase this quarter and home price declines are moderating or flattening, it may indicate we are at the peak of the negative equity cycle. However, until negative equity recedes and unemployment declines, mortgage risk will continue to be very elevated," said Mark Fleming, chief economist for First American CoreLogic.

Methodology*:

First American CoreLogic has created state- and CBSA-level negative equity estimates for all single-family residential properties in the U.S. The data includes 47 million properties with a mortgage, which accounts for over 90 percent of all mortgages in the U.S.*. The data was revised for 2009 and the revisions included a large addition of junior liens (including multiple junior liens), additional residential property types that were previously excluded and a broader range of home values. The net impact of the revisions was an increase in negative equity.

First American CoreLogic used its public record data as the source of the mortgage debt outstanding (MDO) and it includes 1st mortgage liens and junior mortgage liens in order to capture the true level of mortgage debt outstanding for each property. The current value was estimated by using the First American CoreLogic Automated Valuation Models (AVM) for every residential property in the U.S. The data was filtered to include only properties valued between $30,000 and $30 million because AVM accuracy tends to quickly worsen outside of that value range.

The amount of equity for each property was determined by subtracting the property's estimated current value from the mortgage debt outstanding. If the mortgage debt was greater than the estimated value, then the property is in a negative equity position. The data was created at the zip code level and aggregated to the state, CBSA and U.S. totals.

*Note: Only data for mortgaged residential properties that have an AVM value is presented. There are several states where the public record, AVM or mortgage coverage is very thin. Although coverage is thin, these states account for fewer than 5% of the total population of the U.S. The mortgage debt outstanding was not adjusted for amortization, however the majority of mortgages were originated within the last six years where the difference between the original mortgage debt outstanding and current mortgage debt outstanding is not large.

======================================================

Source: First American Core Logic, a member of The First American Corporation (NYSE:FAF) family of companies, is the largest provider of real estate, property and ownership data and advanced analytics for information on foreclosures, delinquencies, median home prices, home price indices, home valuations, sales activity and mortgage loan originations. The market-specific data covers 7,607 ZIP codes, 958 Core Based Statistical Areas (CBSA) and 3,050 counties located in all 50 states and the District of Columbia. This data represents 99 percent of the United States population, 140 million (97 percent) of all properties, more than 50 million active mortgages and $2 trillion in loan-level, non-agency mortgage securities. First American CoreLogic products and services enable customers to better manage mortgage risk, protect against fraud, acquire and retain customers, manage credit risk, mitigate loss, decrease mortgage transaction cycle time, more accurately value properties and determine real estate trends and market performance. More information about First American CoreLogic can be found at www.facorelogic.com.

Articles for August 12, 2009 | Articles for August 13, 2009 | Articles for August 14, 2009

Salem-News.com:

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Henry Ruark August 13, 2009 6:50 pm (Pacific time)

To all: Horrendous conditions which created this damnable economic messs started with Reagan era imposition of slashed taxes for the rich, deregulation, privatization, "supply side" theoretical approach to the realities of national and international trade, finance and governance. Prior Op Eds, around 20 or so, have developed strongly documented details about the whole massive misgovernance, and are available via Archive access right on this S-N channel. Began writing re Reagan's politicala sell-out after his personal rescue by GE for use at their plant sessions when that was just taking place, and have not stopped since. Recent Op Eds provide still further provenance of every point now in consensus via worldwide economic sources, for your further "see with own eyes" and cogitation. IF any doubt still remains, ID self in full with working phone to Editor and for small fee will furnish page on page of specific sources for your OWN check. Fact is fact, and malign fantasy is just that. IF you know truth when you find it here, and appreciate it when found, "that's the way it is"...!!

Henry Ruark August 13, 2009 6:40 pm (Pacific time)

"Anon:" For 60 working yrs have been doing my own "research" and reporting in public press, now approaching 7 million printed words, paid for by editors. You, sir, lie in your teeth, for whatever reason, obviously malign and massively misinformed or malignly intent on telling your lies for your own private purposes. Dead giveaway is that you fear revelation so much you dare not sign your name, and avoid "hide-nain" since many of you now learning the very use of Internet is dead giveaway for anyone wishing to seek out from whence such garbage comes, and thus easily deduce why. IF you have documentation from any solid reliable national source, NON-political by obvious check and own admission required there by FCC, cite it and let us "see with own eyes" and "evaluate with own mind", rather than depending on distorted and perverted flat-out floo-floo from masked man at door, whom we would never allow within our sacred American homes.

Anonymous August 13, 2009 5:22 pm (Pacific time)

this isnt even close to the tip of the iceberg, no matter what the mainstream media and government says. And, thru my research, the reason obama is pushing thru the health care plan is to save the insurance agencies from their trillion dollars of worthless derivatives. Another bailout, via a health care plan that will control every aspect of your life. Win/win for the elite, yet again. While WE lose. Is it obvious yet? Or do you have to be on the streets, or show your ID at checkpoints before ya get it? Sept 30 is end of the fiscal year. This is why the bailout was pushed last year. Watch for bank holidays in the very near future.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.