Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jun-21-2012 22:50

TweetFollow @OregonNews

TweetFollow @OregonNews

Study Shows Extent to Which Congressional GOP Tax Plan, Compared to President's Plan, Favors Wealthy Oregonians

Salem-News.comBy the end of 2012, tax cuts enacted during the Bush Administration are set to expire.

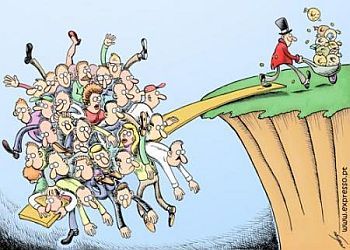

poweromics.blogspot.com |

(SILVERTON, OR) - With several federal tax provisions set to expire by year's end, congressional Republicans are pushing a plan that would extend all tax cuts for the wealthiest 1 percent of Oregonians, resulting in an average tax cut of $51,550 in 2013, according to a new report released by the Washington, D.C.-based Citizens for Tax Justice (CTJ).

President Obama's tax plan, by contrast, would provide a smaller tax cut for the wealthy -- $18,060 on average for the top 1 percent -- and extend some expiring tax cuts that low- and moderate-income Oregonians today enjoy, the CTJ report said.

"Our federal tax policy should strengthen the middle class and protect the vulnerable in Oregon, but the GOP tax plan fails this test," said Janet Bauer, policy analyst with the Oregon Center for Public Policy, who examined the CTJ report. "The President's tax proposals are more in tune with the needs and aspirations of Oregonians."

By the end of 2012, tax cuts enacted during the Bush Administration are set to expire. These provisions would have expired at the end of 2010, but Congress extended them for two years.

Also set to expire by year's end are expansions of the Earned Income Tax Credit (EITC) and Child Tax Credit put in place by the economic recovery act signed into law by President Obama in 2009. The expanded credits benefit many low- and moderate-income Oregon families.

Unlike the GOP plan, President Obama's tax proposal would continue the expansion of the EITC and Child Tax Credit.

The President's plan would also extend the so-called Bush tax cuts on the first $250,000 of household income and the first $200,000 earned by individuals. As explained in the CTJ study, "This would mean, for example, a married couple with $1 million in income would continue to enjoy the lower tax rates enacted under President Bush for (at least) their first $250,000 of income in a year, but would pay the higher tax rates in place at the end of the Clinton years on the remaining $750,000 of their income."

In 2013, Oregon households in the bottom fifth of the income scale would receive $60 less in tax cuts under the GOP plan than they would under the Obama plan. This is because congressional Republicans' current tax proposal would allow the 2009 expansions of the EITC and Child Tax Credits to expire.

The GOP congressional plan would also extend all expiring tax cuts for the wealthiest Americans, rather than cap some of them, as does the President's plan.

Under the congressional Republican plan, 27 of every 100 tax cut dollars flowing to Oregon would go to the state's wealthiest 1 percent of households, CTJ estimated. Under the President's plan, the ratio would be 11 of every 100 tax cut dollars.

Middle-income Oregonians would also fare better under President Obama's plan, according to CTJ's analysis. On average Oregonians in the middle rung of the income ladder would get $90 more in tax cuts under the President's plan than under the GOP proposal.

"Lavishing massive tax cuts on the wealthy in Oregon won't restore prosperity but will deprive our nation of needed revenue to create jobs now and invest for the future," said Bauer. "We need our tax policy to confront today's most pressing challenges -- protecting the most vulnerable among us and creating economic opportunity for all."

The Oregon Center for Public Policy is a non-partisan research institute that does in-depth research and analysis on budget, tax and economic issues. The Center's goal is to improve decision making and generate more opportunities for all Oregonians.

-------------------------------

Tweet

Follow @OregonNews

|

|

|

|

|

|

|

Articles for June 20, 2012 | Articles for June 21, 2012 | Articles for June 22, 2012

googlec507860f6901db00.html

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Anonymous June 22, 2012 2:09 pm (Pacific time)

Why blame the democrats? We need a third party in Congress, to offset the two-party power struggle, and give a a real democracy. Get rid of the Corporate power.

Anonymous June 22, 2012 6:14 am (Pacific time)

People who pay more taxes naturally get more back when taxes are reduced. Considering that we now have around 50% of the population pay zero in federal taxes, who supports their funding in their various government programs? The government does not create wealth, they re-distribute it. Considering that Obama's policies have been utter failures, which past economic models have helped spur a better economy for most everyone? You ever see a poor person create jobs of any long lasting existence? It was the democratic control of congress beginning in 2007 that saw unemployment go from around 4 and 1/2 percent up to current levels. It was their housing loan policies in the 90's that set up the "bubble." Beware of groups that call themselves "non-partican" (generally for tax-free purposes) while pushing for partisan agenda's. Time to change leadership and go back to economic models that we know at the very least are better than the socialist/marist models being pursued. Eventually they run out of other people's money, then you have tyranny. Is that what they want? Yes! For example, why is Obama claiming "Executive Privivlige" for Fast and Furious?" Review the law, look at his budget proposals since in office(none received even one vote in support), now what has he done? Where is the "transparency?" Those of you concerned with Zionism, then go to Silverton Oregon and see it alive and well.

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.