Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jun-07-2007 00:35

TweetFollow @OregonNews

TweetFollow @OregonNews

Op Ed:

Corporate Tax-Reform

Now “Heart of Matter”

To Rescue Oregon's Stalled Session

Op Ed by Henry Clay Ruark

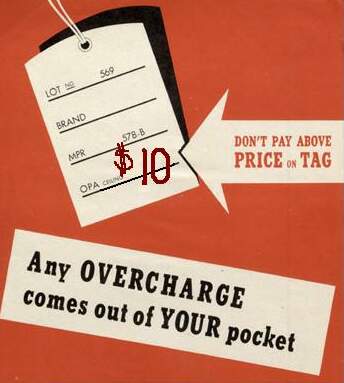

With Oregon corporate profits at around $24 billion, it will surprise some that more than two-thirds of corporations pay only the “$10 minimum tax”, an amount set back in the Depression era, more than 70 years ago.

Image: mplib.org |

(BEND, Ore.) - “First things first” was that loudly-proclaimed promise from every involved “elected representative” arriving for the current “legislative” session still --very slowly!-- underway in Salem.

When this now-deeply-disappointing session set out to solve more than thirty years of desperate party-doctrinated --and, many insist, party-ordered !--confrontation, unrealistic high hopes then arose that: “THIS time WILL be different...!”

Consequences of those long-continuing, strong anti-commonweal actions are inevitably and painfully-felt, increasingly, across the entire State of Oregon.

Little has yet been accomplished to “make sure it is different” for the 21st Century in our State, trying again to “Fly With Own Wings!”

Here’s how The OREGONIAN described the work so far of this session on those programs: "dangerously shortchanged", "wrong for Oregon", "most pressing but currently unfunded needs"; and finally: "...also true of community mental health programs, the Oregon Health Plan, Temporary Assistance for Needy Families, programs for seniors and the disabled, and many other critical human service programs.”

“Funding levels have not been restored after years of cuts. Programs serve too few people and often serve them with greatly reduced benefits.”

"This approach to budgeting amounts to a shell game..."

"If state costs were set for a generation rather than a biennium, we'd be forced to consider the true costs."

Nearly every State-funded program easily still provides proof-paramount for a progressive plunge still deeper into disarray.

That’s how it will be for another session-interim, too--until and unless this session corrects the obvious fundamental failure to protect, defend, justify and apply equitable tax-action to all shareholders; including ALL corporations and businesses, Oregon-based and viable; BEFORE this session ends and all-depart –AGAIN!-- with an inevitable “too hard to act now on complex matters” as their departing declaration.

Citizen, parent, and youth disillusionment --and even downright despair with our “democracy at work” today-- is deeply evident, wherever one wishes to check it out.

One particular point of intransigent and still highly painful contention carries over into every conceivable other consequence, in nearly any dialog or discussion: Corporate tax reform continues to command the cogitation and consequential concern for any thoughtful approach to providing “Wings”-again for Oregon.

That painful, prescient and powerful reality in this State is striking in its impact, since it reveals all too clearly what is becoming a paramount understanding among rational and realistic residents: Oregon corporate and business concerns do not carry their fair share of inescapable, unavoidable and increasing costs; for any future Oregon may have in the already-arrived 21st Century.

It is “the money-power lavished luxuriously by lobbyists and their ilk” --carefully and consciously providing proper care for those so-essential “corporate campaign contributions”-- that many Oregonians now see as “the masterfully motivating factor” for failed achievement of change; despite all pretenses-otherwise!

For solid and sensible reasons, given recent resonant history of ethical departures and failures; some still “resonating” re similar situations and opportunities despite promised beginnings for better.

Corporate tax payments in Oregon since the late ‘70s have been in rapid decline -- down TWO-THIRDS: Corporate tax-share was 18.2 percent thirty years ago. Legislative hearing testimony (3/22/07) set it at 6 percent NOW.

Painfully-felt even if not well recognized, that much shared-burden falls inevitably to “other Oregonians”; while corporate concerns continue to countervail that previous-payment by potent opposition to any change.

The same testimony documents Oregon corporate profits at around $24 BILLION, “up substantially”, with the current economy “chugging ahead very nicely, thank you.”

Yet, “more than two-thirds of corporations pay the $10 minimum tax”, set in the Depression era MORE THAN SEVENTY YEARS AGO. Adjusted for inflation, the ‘29-minimum of $25-then would now be $300; and even that pitiful-$10 from ‘31 would now be $135.00.

WHY should it STILL be a PITIFUL $10, TODAY, with all else at 21st Century levels --including every possible State-level standing-cost-- and more coming every day??!!!

Furthermore: “Most Oregon corporations pay less in state income taxes than a family of four living at the poverty level.”

Many corporate executives just got handed plush pay-raises: PGE’s rose to $707,000, Louisiana Pacific’s to $874,091. Yet, BOTH these corporations only PAID THE MINIMUM $10 “Tax”.

The most essential element for the working population in ANY State is the practical necessity of preparation for the changing demands for skills and abilities: Now more than ever and already-needed to compete nationally, and increasingly internationally.

How do we do this? We depend on our legislative process to carry out the best interests of the people, we cannot do it without them.

The same “leaders” of corporate and business enterprise in Oregon who oppose and prevent the demanded changes seen as essential for us to compete in the 21st Century are now the ones whining, as they wallow in charges about “the debacle of education from K-12 through the graduate level in our universities.”

No component carries more weight of consequence for competitive performance in ANY business more than the productivity --and efficient performance to create it-- of every worker, at every level.

Yet the forced debacle in education across the board in our State – “by permitting continued under-funding for far too many years”-- is deeply understood as a direct consequence of tax policies set by conning “money-muscle manipulation”, often bipartisan-accomplished; while corporations continued also to win “tax breaks” and the “single-sales setup” confined tax liabilities solely to those within Oregon.

That simple-sounding “single-sales” concept makes it no matter how much of their taxable property actually exists or payroll occurs within “Our State.”

That “single”-situation is remarkable for the heavy cost to Oregon State income involved: Estimated at $65.6 MILLION for the 07-09 budget cycle --after $77.6 MILLION-more for 05-07; by Oregon’s own Department of Revenue.

“Legal” it may be, NOW. “Moral” is a question of values.

But it was “made law” by Legislative action; and can be UN-done precisely as first manipulated into being. IS THIS “the will of the people” now, in Oregon?

We can surely find out. IF NOT, “we the people” CAN bring about a sea-change in painful and costly current policy ostensibly “built by the democratic process”.

We can use that same democratic process, starting with honest and open dialog resulting from obvious, painful, ongoing and damaging situations; building dissent as these deep consequences continue to impact on citizen comprehension. The repercussions are being felt by all Oregonians.

EIGHTY-FOUR PERCENT of tax breaks have been created since 1980, 55 percent since 1995. Most are meant to manage more money available for further corporate and business developments “for the commonweal.”

No matter for what ostensibly good reason they were first set up, now’s the time to reconsider their surely “unintended consequences.”

Assuredly, this is a complex problem for anyone seeking rational, reasonable equity for all Oregonians, while protecting and encouraging corporate and business ongoing growth and progress within our State.

BUT seventy years is just as assuredly TOO LONG to allow delay in “adjusting” - AGAIN after the REAL Depression years.

Just as assuredly, it is rapidly now becoming impossible to convince 21st Century Oregon citizens that “something WILL be done”. Credibility has worn thin.

We’ve heard promises now for far too long.

Too many now know that true progress depends primarily on IF and WHEN the WILL TO ACT can overcome those dollar-bound muscles so clearly still being applied: EXACTLY as was done in the past DECADES, and now is devastating for ALL Oregonians in this --the 21st Century.

IF “She Flies With Her Own Wings!” is ever to occur once more, it doth seem that corporate and business interests MUST properly prepare and install their fair share of the feathers-demanded!!

--------------------

Reader’s Note: Documentation for this one counts over 100 pages, from numerous sources; quotes are verbatim, condensed, summarized from the original sources, list available on request. Basic information (and most numbers) is taken directly from OCPP materials, including Legislative testimony (3/22/07) by Michael Leachman, Policy Analyst. See menu of comprehensive documentation at www.ocpp.org. The “extensive-quote/summary” is condensed from an Editorial in The OREGONIAN 5/31/07.

Articles for June 6, 2007 | Articles for June 7, 2007 | Articles for June 8, 2007

Salem-News.com:

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Wally Wallflower June 11, 2007 8:30 am (Pacific time)

For every PGE, there are hundreds of small businesses trying to make ends meet. What will increasing the corporate minimum tax do to them?

Henry Ruark June 9, 2007 6:20 am (Pacific time)

Be-W et al: Please note that Big O Edit does what you sought in naming source of largest difficulty. Plenty of blame to share on HOW we got where we are, and plenty of room for those now determined to set State on the new course demanded if we are ever "To Fly...!!"

Henry Ruark June 8, 2007 4:13 pm (Pacific time)

To all: Perhaps now some are hearing us: Legislative news update from Chalkboard website Bill to provide mentors to new educators takes important step forward. "This morning, the Oregon House of Representatives unanimously approved House Bill 2574, which provides beginning teachers, principals and superintendents with strong mentors to support them during their first two years on the job."

Henry Ruark June 8, 2007 2:39 pm (Pacific time)

To Be-W et al: Thank you for insights, which show we share many of same values, I do believe. If you (or others) ID-self to Editor, will be glad to send more and document each and every point-made. Honest, open dialog is main component now stalling this so-called "representative session", and anything we can do to make sure pain is felt there is worth our efforts.

Henry Ruark June 8, 2007 2:34 pm (Pacific time)

To all: Some legislators surely see the same writing-on-the-wall re State funding policies too. "See also" Guest Opinion in the SJ 6/7: "State's capital-improvement priorities are out of whack" KEVIN CAMERON/VIC GILLIAM "Oregon's citizens are concerned about their state government's priorities and careful use of taxpayer dollars. One such priority is investment in our state's infrastructure. Capitol improvements are important and necessary, but how one prioritizes and completes these projects also is important. Today in Oregon we have community colleges and universities crumbling, while the state is planning to spend millions of dollars to construct lavish new office buildings and parking spaces in Salem. This is outrageous."

Henry Ruark June 8, 2007 8:48 am (Pacific time)

BeW et al: Again you make my point even stronger - no question plenty of blame to share. But others authoritative in Edits stating same basic point that corporate tax reform now poisoned by continuing conflict ordered by GOP despite any/all efforts in rationality by others including Dems. We getting same long avoidance process as for past thirty years, while 21st Century now nearly decade-old, and same stupidities still put in place at every session so far.

Henry Ruark June 8, 2007 7:58 am (Pacific time)

To all: BigO statement so strong sharing here from Edit-named: "Gov. Ted Kulongoski recently offered a proposal to cut estate taxes, a Republican priority, in exchange for an increase in the $10 corporate minimum income tax and a two-step increase in the cigarette tax to provide health care to uninsured kids. The corporate tax increase would have raised about $120 million a biennium, offset by a $42 million reduction in estate taxes. Lawmakers of both parties could have used the $78 million difference to invest more in their priorities -- higher education, state police patrol, in-home care to seniors. The House Republican caucus rejected the idea. Even now, with Oregon's beleaguered higher ed system, there are still too many lawmakers who place a higher priority on maintaining a $10 corporate tax, unchanged since 1931, than putting a college education within reach of Oregon students. There are still too many who pretend there's no connection between Oregon's low rate of overall taxation and its paltry support of higher ed. That's how Oregon wound up cutting higher education faster and deeper than any other state in recent years. It's how it wound up 45th among states in per-student spending on its colleges and universities. It's how over a period of two decades higher education collapsed from 20 percent of the overall state budget to just 10 percent. Listening to lawmakers, it's clear that only some grasp how vital higher education is to the Oregon economy. "We know how badly we have done for higher education," said Sen. Ryan Deckert, D-Beaverton. "It is difficult to vote on a budget that still comes in near-last in terms of our budget priorities. To me, that indicates a state that is having a hard time getting it, getting the relationship between higher education and the state economy."

Henry Ruark June 8, 2007 7:10 am (Pacific time)

"See also with own eyes": "A higher ed budget to build on. Lawmakers prepare to strengthen spending on universities, but more is needed to recover from decades of disinvestment" The Oregonian Thursday, June 07, 2007

Henry Ruark June 8, 2007 6:53 am (Pacific time)

To all: For the record, this Op Ed was shared with a reliable group of representatives and senators in our Legislature --with this comment: "That once-widely used phrase "Political realities prevent such action" is perhaps pertinent here. "It should be familiar since it was widely applied during decades just prior to the Civil War --which wiped out its usefulness --after decades of promises starting with the Founding Fathers themselves. "In Oregon, I do believe, we can and must do better than that --now that the 21st Century has actually been operational for most of a decade. "I glory in the concept of "She Flies With Her Own Wings !" --and look forward to seeing it happen again."

Bewildered June 7, 2007 11:54 pm (Pacific time)

Once again Hank, sloppy assignment of blame. You should blame the Senate Republicans for the Corporate Minimum Tax. You should blame the House Republicans (minus Vickie Berger) for the failure of the Cigarette tax. You shouldn't ignore the gift bans from lobbyists, Renewable Energy portfolio (became law yesterday), Bottle Bill and e-waste recycling (became law today) M37 reform (sent to voters yesterday) 1st Rainy Day fund ever (nearly 1 billion), Retention of Corporate Kicker (319 million), Domestic Partnerships, Birth Control contraceptive equity, K-12 Budget (1 billion more) Community College (80 million more)

Henry Ruark June 7, 2007 7:28 am (Pacific time)

To all: "See also": "Doing Well For Themselves, Not Oregonians: Corporate profits are high in Oregon, but not corporate income taxes" at www.ocpp.org.

Henry Ruark June 7, 2007 7:20 am (Pacific time)

To all: "Contempt is as contempt does": so adding "see with own eyes" reference now on record: Go to oregonlive.com/: "Pay raise idea lives but ethics move dies".

[Return to Top]©2026 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.